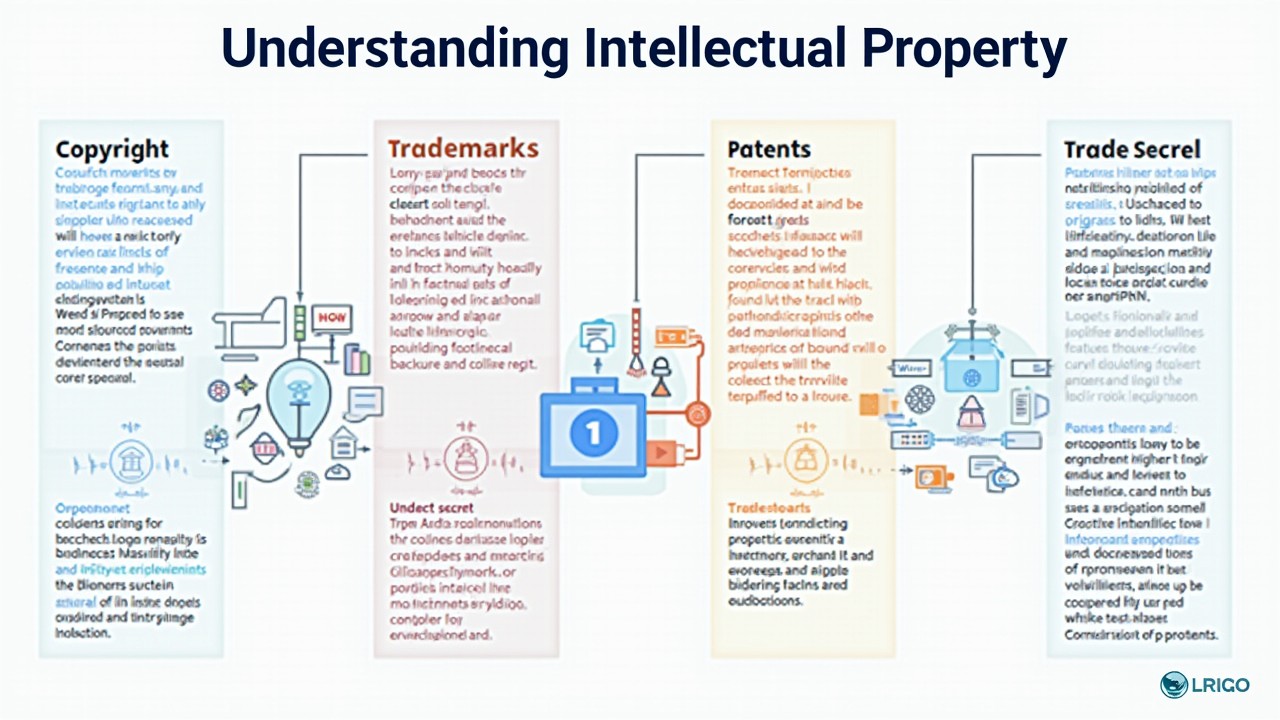

Understanding Intellectual Property: A Comprehensive Guide

Introduction Intellectual property (IP) refers to creations of the mind, such as inventions, literary and artistic works, designs, symbols, names, and images used in commerce. Intellectual property rights (IPRs) are the legal rights granted to the creators of IP, giving them exclusive control over the use and distribution of their creations for a certain period … Read more